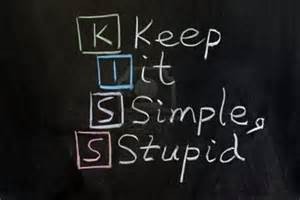

When I started running workshops for startup entrepreneurs, a colleague who ran the financial portion held up a simple, hand-written sign. This is what it said:

Sales – Costs = Profits

He then talked about the sign’s simple message, and stressed that the success of a startup is, at the end of the day, how much money you have at, well, at the end of the day.

He also discussed how the more we complicate this message, the more we get off target. By “complicate,” we mean things (that even experts debate) like worrying about depreciation, inventory valuations, and “accrual versus cash” method, which are all good to know, but not for understanding the nuts and bolts of what makes a successful business.

He also discussed how the more we complicate this message, the more we get off target. By “complicate,” we mean things (that even experts debate) like worrying about depreciation, inventory valuations, and “accrual versus cash” method, which are all good to know, but not for understanding the nuts and bolts of what makes a successful business.

I originally thought this approach was a little simplistic, perhaps a bit dangerous, but have now come to embrace it. [Read more…]

There are lots of great tools, rules, and accountants to help businesses complete and analyze profits, sales, and costs. Unfortunately, this is an area where clients frequently throw out the baby with the bath water. They often fail to use Gross Margin Analysis. Most business people understand the basic rules surrounding Gross Margin. They just don’t execute them.

There are lots of great tools, rules, and accountants to help businesses complete and analyze profits, sales, and costs. Unfortunately, this is an area where clients frequently throw out the baby with the bath water. They often fail to use Gross Margin Analysis. Most business people understand the basic rules surrounding Gross Margin. They just don’t execute them. Several clients and consultants advocate startup capital as entrepreneurs’ greatest need. Our take on this assessment is they have put the cart before the horse.

Several clients and consultants advocate startup capital as entrepreneurs’ greatest need. Our take on this assessment is they have put the cart before the horse. How Poor Forecasting Can Sabotage Your Business Plan (And How to Avoid the Pitfalls!)

How Poor Forecasting Can Sabotage Your Business Plan (And How to Avoid the Pitfalls!)