How Poor Forecasting Can Sabotage Your Business Plan (And How to Avoid the Pitfalls!)

How Poor Forecasting Can Sabotage Your Business Plan (And How to Avoid the Pitfalls!)

Introduction

I met with a friend recently who shares my interest in launching and funding startups. He told me an interesting story that resonated at many levels. It went something like this:

Back in the 1980s, when he was seeking his first financing, my friend had lunch with a senior partner at one of Silicon Valley’s top venture firms. During lunch, the VC paused, looked my friend, and said,

“There are three types of companies we end up investing in whether we like it or not:

- The “Dead On Arrival” – those who never make it beyond their initial funding before going belly-up

- The “Living Dead” –those who somehow manage to avoid going belly-up, needing more and more investment capital just to stay on life-support, and

- The “Home Runs” those who so far exceed our hopes and expectations it makes all of the others worth the trouble.”

The VC went on… watching my friend wonder which category his company might fit in to.

“Most of our portfolio companies end up in the first two categories — “The Dead and the Un-Dead”… Nine out of ten, I’d say, and these are the ones we didn’t reject off-hand! But, once in a great while, we’re lucky enough to invest in a “Home Run” — a really great startup that helps us to absorb all of the losses from the others, and make a handsome return for our partners and for us. That’s why I’m buying you lunch!”

The VC paused, then asked my friend, “But do you know what one thing all of these companies have in common?” My friend put his fork down and shrugged his shoulders, waiting for the VC’s answer.

The VC smiled and took a deep breath…

“None of these entrepreneurs had the faintest idea about how to realistically forecast their company’s financial performance!”

“If I see another hockey stick forecast this week, I’m going to throw something at somebody.”

Exasperated Venture Capitalist

My friend learned from that lunch what I have also learned in my years of launching and helping fund startups — that few, if any, good investors believe the forecasts presented to them, due mainly to the fact that few entrepreneurs understand the importance of realistic forecasting.

In the words ahead, I will share with you some of the major ways poor forecasting can sabotage your business plan and your financing. I will also share some of the lessons I have learned about how to avoid these pitfalls, and secure the financing you need to launch and grow your enterprise.

Forecasting: The Forgotten Part of the Plan

I frequently read detailed multi-page start up business plans with pages of description and financial detail of every line including details such as paper supplies and print ink. However, one of the most important drivers of the plan — the forecast — is often comprised of a few paragraphs or less. In point of fact, forecasting is often relegated to a minor role in the business plan, and often key elements are overlooked. Examples include:

- One client forecasted a one percent sales growth per week based on what a venture capital firm told her was required for financing

- Clients frequently ignore competition and pricing details, including the role of online distribution such Amazon and Ebay in developing their forecasts

- Market forecasts frequently ignore key market segments and niches. For example, premium customers and products frequently represent less than 10-20% of a plan’s total market. Mass merchants, such as Walmart and Target, can represent 30-60% of a retail product market while boutiques and specialty retailers may be inconsequential.

The process of giving the business plan forecast its deserved place is not easy. This is so for many reasons, including:

- Forecasting is difficult (if not impossible) to do accurately. Key assumptions required for good forecasting are not always evident, and key metrics are not always clear. In the absence of a clear path by which a forecast might be developed, many entrepreneurs gloss over it. For example , the most reliable and recommend tool for forecasting is a company’s own historical track record, which is simply not available for startups.

- Forecasting is easy to over-simplify. The proverbial “Hockey Stick” graph of revenue growth is a classic example of this. The fast growth rate looks impressive on the surface, but the entrepreneur’s lack of restraint leaves the opposite impression with investors. The steeper the pitch of the hockey stick revenue line, the more investors will question the entrepreneur’s business judgment. I read a plan a short time ago that had 20 beautiful pages of financials and charts based and about one paragraph on the assumptions behind the forecast coupled with — you guessed! The Hockey Stick.

- Forecasting is often not based in reality. Demand, competition, market size, pricing, marketing expense, etc., must all be considered, quantified, and explained in developing a solid and credible forecast. For example, the current mantra seems to be that social media networks will generate whatever “buzz” and sales a company needs. However, this argument seldom has a solid explanation regarding how, what, when, and where such meteoric growth in customer awareness and purchasing will occur.

Avoiding the Pitfalls of Poor Forecasting

So how does one develop a good forecast with little market data, no history and a brand new product or service? My approach — developed over many years of experience — is to utilize a variety of time-tested tools, and then to develop a most likely scenario based on the best information available.

Before starting this process, you must learn to avoid what is generally called “confirmation bias.” Here’s where things can easily go wrong in most forecasts and market testing. It’s human nature: we usually test to prove our hunches right. We start our forecasting with a favored option and try to build a case around it. We may deny this tendency, but it is all too common among hopeful entrepreneurs. The result is that the less-favored alternatives usually get short shrift — and these are often the more probable scenarios. The more that there is at stake in the test, the more susceptible we are to Confirmation Bias.

Never state that you have no competition. Such a statement means one of two things to investors: either your business sucks, or you haven’t done your homework and you don’t know your business. Even the most amazing disruptive game-changing plans have competition, if not now, then tomorrow.

Some suggestions for mediating this dilemma are:

- Define your market in terms of products, demographics, region, prices, distribution, and growth, etc.

- Use surrogates like sales per sq. foot, other web sites or other services to develop parameters on your business. For example here is a simple chart for one person providing personal services by hours and rates

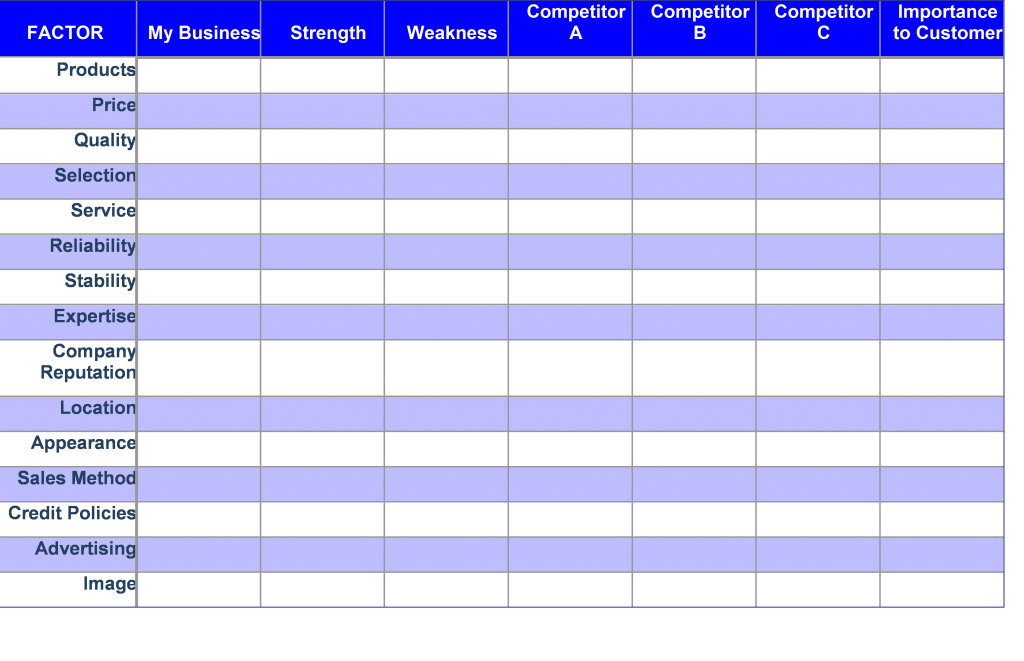

Other key elements of realistic market assessments pertaining to your forecasts include:

- Why are you different?

- What is your history or comparisons with competitors?

- What is the market capacity and trending?

- How will marketing generate your sales?

- How will competition react to your initiatives?

- Who might enter the market once you appear on the scene?

A final word about Market Assumptions

The first stage in creating the sales forecast is to estimate Market Demand. Market Demand for a product is the total volume that would be bought by a defined customer group, in a defined geographical area, in a defined time period, in a given marketing environment.

Once you have estimated the total market demand, you can estimate your company’s share of that demand:

Company Demand = Market Demand X Company’s Market Share

The final element in forecasting market demand is to look at future demand for your products or services. Future demand is based on the growth of sales in the industry and changes in the market share.

Sales Forecasting

Accurately predicting future sales is perhaps the most difficult aspect of the forecasting process. This is based on what management expects to happen to the company’s market share, coupled with the estimated demand for the company’s products or services at the proposed price points.

Specific sales forecasts can be based on a integrating a variety of information and efforts:

- Actual customer buying results and attitudes. For example how do price changes , or promotions affect sales on a long and term basis?

- Marketing and brand efforts and long term impact.

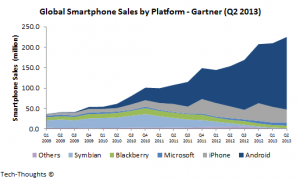

- Competitive and distribution changes. For example retail store sales are growing about 1 % a year and internet sales 15-20%.

- What customers have done in the past in the market.

- Time series trends for the market and company.

- Seasonal or cyclical factors. Sales are affected by swings in general economic activity (e.g. increases in the disposable income of consumers may lead to increase in sales for products in a particular industry). Seasonal and cyclical factors occur in a regular pattern;

- Erratic events; these include strikes, fashion fads, war scares, and other disturbances to the market which need to be isolated from past sales data in order to be able to identify the more normal pattern of sales.

Conclusion

“Investors aren’t looking for specific revenue numbers or profit margin benchmarks. What they are looking for is a business strategy that makes good, practical sense. Angels would rather invest in a business with a reasonable shot of generating $20 million in sustainable revenues than the $100 million fantasy.”

Seasoned Angel Investor

- Recognize that the playing field is never level. For example, owners of competing businesses may have more contacts in your industry, they may have access to more capital (deeper pockets), and they may even have a stronger support network of family, friends and investors

- Understand the various factors in your business and market to produce better quality, more accurate, and credible forecasts that support your plans to succeed and grow

- Have a clear marketing strategy. You never know where, when, or how a new prospect is going to hear of your business. If you have a mix of messages out there, the prospects will have an unclear expectation of what your business has to offer. Your company must present a consistent, clear message on all fronts

- Understand pricing and pricing dynamics. Lower prices don’t necessarily mean more customers. Many customers are willing to buy more expensive items because of the greater quality or the added convenience. However many presumed benefits are neither real or relevant, and some intangible benefits are not easily communicated

- Clarify the purpose of your company beyond just making money. This will set the stage for attracting like-minded investors, staff, and strategic partners

- Set specific, measurable, accountable, realistic, and time specific goals to ensure continual progress.

- Even if you have the latest, greatest, never-been-done-before approach to something, don’t assume that you have no competition. Competition is more than just the direct, obvious competitors. Competition is also all the available alternatives

- If you go in expecting to be rich overnight, you may become discouraged early on and give up your dream prematurely. Success takes time, perseverance, and a little bit of luck. Give your business time to grow.

A few weeks ago, a client and I were discussing how to improve a business presentation because he thought the material was over some of the participants’ head. He insisted on including as much content as possible. He failed to realize that too much information can lead to failure.

A few weeks ago, a client and I were discussing how to improve a business presentation because he thought the material was over some of the participants’ head. He insisted on including as much content as possible. He failed to realize that too much information can lead to failure. Market Research Overview

Market Research Overview

Branding and Differentiation

Branding and Differentiation

Assuming there are differences between your products and your competition — and assuming that a significant percentage of your customer demographic cares about such differences — how do you best communicate these differences, especially without big marketing budgets and years of reputation from building your brand? For new entries into the markets for cars, phones, beer, detergent, cakes, milk, etc., it is nearly impossible to communicate meaningful differences to the public. However, there are exceptions, especially when a new market category is created. Two inspirational examples with regards to such marketing and differentiation are bottled water and pizza crusts. Who would believe that someone could market water for a dollar or more when water is essentially free? And who would believe that anyone would buy only the crust of a pizza? The lesson here is that if you are hoping to launch a product into a crowded and existing category, you’ll have to work much harder and smarter to penetrate through the “noise” from the competition. On the other hand, if your product represents a truly new category with virtually no competition (yet!) then your branding and positioning need to focus more on the inherent benefits of the product to your customer. Boboli’s motto says it all…”Only YOU can top Boboli!” Key factors that have proven to attract customers to products include:

Assuming there are differences between your products and your competition — and assuming that a significant percentage of your customer demographic cares about such differences — how do you best communicate these differences, especially without big marketing budgets and years of reputation from building your brand? For new entries into the markets for cars, phones, beer, detergent, cakes, milk, etc., it is nearly impossible to communicate meaningful differences to the public. However, there are exceptions, especially when a new market category is created. Two inspirational examples with regards to such marketing and differentiation are bottled water and pizza crusts. Who would believe that someone could market water for a dollar or more when water is essentially free? And who would believe that anyone would buy only the crust of a pizza? The lesson here is that if you are hoping to launch a product into a crowded and existing category, you’ll have to work much harder and smarter to penetrate through the “noise” from the competition. On the other hand, if your product represents a truly new category with virtually no competition (yet!) then your branding and positioning need to focus more on the inherent benefits of the product to your customer. Boboli’s motto says it all…”Only YOU can top Boboli!” Key factors that have proven to attract customers to products include: