When I started running workshops for startup entrepreneurs, a colleague who ran the financial portion held up a simple, hand-written sign. This is what it said:

Sales – Costs = Profits

He then talked about the sign’s simple message, and stressed that the success of a startup is, at the end of the day, how much money you have at, well, at the end of the day.

He also discussed how the more we complicate this message, the more we get off target. By “complicate,” we mean things (that even experts debate) like worrying about depreciation, inventory valuations, and “accrual versus cash” method, which are all good to know, but not for understanding the nuts and bolts of what makes a successful business.

He also discussed how the more we complicate this message, the more we get off target. By “complicate,” we mean things (that even experts debate) like worrying about depreciation, inventory valuations, and “accrual versus cash” method, which are all good to know, but not for understanding the nuts and bolts of what makes a successful business.

I originally thought this approach was a little simplistic, perhaps a bit dangerous, but have now come to embrace it.

Keep it simple – we need to focus on simpler financial statements when making the big decisions for your company and not placing effort into meaningless information with the potential for wrong assumptions, and no room for flexibility.

Questions like: Do you include the cost, selling price, and shipping charges into the actual cost of an item? How “to the penny” must you be? On the other hand, costs like phone bills, accounting, and other business bills, can be more easily estimated.

To help our clients, I have developed a preliminary income statement to help them understand the parameters and potential of their business. While it forces them to consider parameters, it is interactive so they can guess and then immediately see what might work and what might not. It can also be easily customized to meet their needs.

Here are a few other suggestions to consider rather than the typical 20 page financials with meaningless charts and graphs:

- Models need to be flexible and dynamic, not static, like most other plans. In particular, they need to demonstrate how altering variables like price, marketing costs, volume etc. can affect profitability.

- Don’t waste time on minor expenses. Many plans show projections for years with individual expenses like utilities, legal accounting and telephone. These estimates are frequently based on incomplete data and are insignificant. Summary estimates of some categories can be both more accurate and avoid wasting time on minor expenses.

- Developing financial “projections” is a business skill that should be worked on and perfected. Use market research, history, competitor’s information, etc. to develop your own projections. Check reputable sites like Google and Amazon to validate your estimates.

- While it may be obvious, many plans ignore the need to integrate components. These issues can range from forgetting shipping costs or returns to more complex like the impact of pricing, promotions and marketing on volume and profits.

It’s unforgiveable that today’s financials try to predict the “five year forecast.” First of all, not even the most experienced business owner can accurately predict 5 year sales with any real accuracy. Second, since every new startup thinks they are the next multi-million or billion dollar business, they will unrealistically predict revenues in the $15-20 million range to boost their own ego, and attract investors.

It’s unforgiveable that today’s financials try to predict the “five year forecast.” First of all, not even the most experienced business owner can accurately predict 5 year sales with any real accuracy. Second, since every new startup thinks they are the next multi-million or billion dollar business, they will unrealistically predict revenues in the $15-20 million range to boost their own ego, and attract investors.

Or, how about this: A client forecasted a growth rate of 15-20% per week. When asked how she came about that figure, her response was: “That’s what the venture capital firms say they want”

Oops.

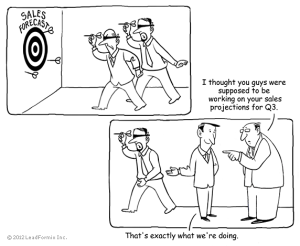

While ignorance is bliss, and playing the financial projections’ game blindfolded may seem like a good idea at the time, your business deserves better. Go ahead, play a game of darts, with not when the aim is the future of your business.

Dr. Bert Shlensky, president of www.startupconnection.net, offers experience and skills and a team devoted to developing and executing winning strategies for businesses of all kinds. This combination has been key to client success.